Our Experts

We empower Anti-Financial Crime and Corporate Risk Management Professionals

We empower Anti-Financial Crime and Corporate Risk Management Professionals

AML DIRECTOR AT BITOASIS

An experienced professional with an extensive Compliance, Control and Operations background spanning over 15 years. Works well in challenging, fast-paced and deadline-oriented environments individually or as part of a team. Proficient in designing, embedding and managing effective Automated Compliance Systems, Policy Framework, Programs and Processes.

CAMS | SANCTIONS COMPLIANCE OFFICER | CO-CHAIR ACFCS CEE CHAPTER

Denitsa Rebaine has over 7 years of experience in financial crime compliance. She is the EMEA Deputy Head of Sanctions at a US investment banking services company. In her role, she manages sanctions risk and provides advice and guidance to functional partners and key stakeholders – regionally and globally, on OFAC, and EU/UK sanctions.

FOUNDER, COMPLIANCE EXPLAINED

Jochen transforms classic compliance training into creative communications and trainings. He’s a former trade compliance attorney and has held in-house positions as a compliance officer and legal counsel. Check the website with tips & tricks on compliance training and communication: complianceexplained.com.

HEAD OF COMPLIANCE, HUGOSAVE

Julia Chin is the Head of Compliance at Hugosave, Singapore’s first Wealthcare® and savings app. A seasoned finance industry professional, Julia has over 25 years of experience in policy implementation with a focus on client due diligence and operational risk management. She is a subject matter expert on Correspondent Banking, Securities Services, and Fintech – in the areas of Financial Crime and Regulatory Compliance.

BUSINESS DEVELOPMENT SPECIALIST, YOUCONTROL

Oksana Kharchenko is a member of the YouControl, Ukrainian team of enthusiastic developers who have been developing analytic services based on open data, AML and KYC systems used by international companies since 2014. The YouControl system has gained considerable recognition in Ukraine and South Europe, it is used for regular compliance with 95% of banks and financial institutions represented in Ukraine.

FINANCIAL CRIME AND REGULATORY TRANSFORMATION SME, LUCINITY

Francisco is using his experience in Financial Crime and Intelligence to integrate different capabilities into solutions that can improve prevention, detection and investigation of Financial Crimes. Francisco is the former Head of Data and Analytics for Wealth and Personal Banking Financial Crime Risk at HSBC.

ADVISORY BOARD MEMBER, FINANCIAL CRIME ACADEMY

Boris is a seasoned scholar with extensive experience in company secretarial and compliance areas. He is the holder of an MPhil., MBA, LL.B., LL.M. and MSc. He is also a chartered company secretary and qualified accountant. Boris has more than 10 years of experience in the company secretarial and compliance areas. He has been invited as a speaker at various webinars relating to AML and compliance topics.

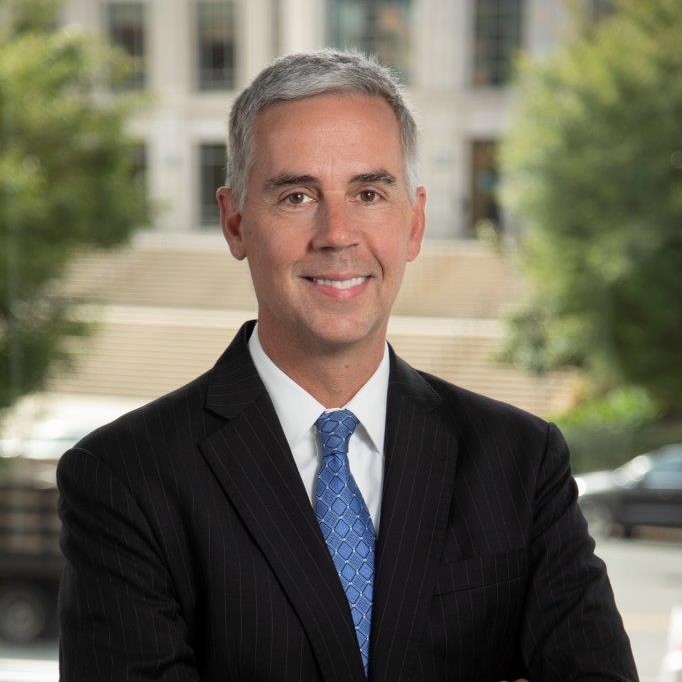

PARTNER AND MANAGING DIRECTOR, ALIXPARTNERS

Internationally recognized as a “financial crime expert” (CNN) for his roles in investigating and remediating some of Europe’s biggest compliance and risk matters. This includes major anti-money laundering, terrorism financing, sanctions compliance, securities compliance, tax, corruption, asset tracing, financial statement, and ESG matters.

DIRECTOR INTERNATIONAL PROGRAMS, CENTER FOR INTERNATIONAL CRIMINAL JUSTICE

Giovanni Marotta has proven success in developing innovative, highly measurable legal strategies in clients’ favor in different juridical expertise areas. Adept at consistently improving legal research through content international case law, doctrine, the rule of law, and an unswerving focus on leading legal’s edge strategies.

FOUNDER AND CEO, THE MEKONG CLUB

Matthew Friedman is a global expert on modern slavery and human trafficking. An award-winning filmmaker, author and philanthropist, Matthew regularly advises heads of governments and intelligence agencies. Matthew is considered the leading catalyst of the anti-slavery movement in Asia’s business sector by captains of industry.

BUSINESS OWNER, AML CUBE

Anna Stylianou has 20+ years of experience in the financial industry sector, she helps people understand how financial crime works in a simplified way. Having long-term practical experience in banking, electronic money services, and the investment industry, she has an overall understanding of compliance requirements in the overall financial sector.

FINANCIAL CRIME COMPLIANCE CONSULTANT, FCC CONSULTING

Michael Harris is a experienced business leader who has held executive and non-executive roles in a variety of sectors. Double Honours degree qualified in Engineering and Commerce and a Member of the Chartered Management Institute. Since 2008 has been specialised in the financial crime compliance sector providing risk intelligence data and technology and a subject matter expert in KYC/AML in financial services and Anti-bribery and corruption risks, KYS, third party on-boarding and ongoing monitoring.

ANTI-FINANCIAL CRIME AND ASSET RECOVERY SPECIALIST

Ielyzaveta Fomina has essential knowledge and practical experience in recovery of assets, derived from corruption and other crimes. She specializes in finding and tracing of assets, aimed to be seized in criminal proceedings within close cooperation with law enforcement authorities as well as competent authorities of foreign states, global and regional asset recovery networks.

TRAINER & COACH, AML COMPLIANCE

Girish has been a professional Banker who understands the dynamics and different processes of AML & Compliance in Retail Banking & MSBs. He has designed and delivered programs in the areas of AML & Compliance, Fraud & Cyber Security Awareness, and in Banking Operations. Developed and delivered training programs for one of the largest banks in UAE, which demonstrated significant improvement in branch audit scores & sales, and reduction in fraud incidents & ops risk losses.

SCHEME COMPLIANCE MANAGER, NEXI GROUP

Louie Vargas, is passionate about learning and spreading knowledge around anti financial crime compliance and sanctions. This is illustrated by his high activity on LinkedIn, sharing with colleagues, and founding/Chair of the ACFCS Nordic Chapter. He previously works as a Principal Compliance Officer focusing on screening (sanctions, PEP, and adverse media screening) controls and technology enhancements for the largest Danish bank.

FOUNDER, MEGARA

FOUNDER AND CEO OF ADVANCED FINCRIME SOLUTIONS LLC

Casey Nelson is a certified anti-money laundering specialist (CAMS) with over 15 years of experience in financial crime investigation and compliance. He spent most of his career working for one of the world’s largest global banks, where he served as a senior investigator in the AML compliance department and led the global Financial Crime Compliance training program.

MANAGER LEGAL AND REGULATORY AFFAIRS

Deepanjan Mallick is a seasoned professional with 15+ years’ experience in the banking and financial services domain having worked across banks like HSBC. Citi, JP Morgan Chase, Paypal and currently deputed as the Legal, Regulatory, Compliance Officer for Emerchantpay UK. Throughout the 15 years of his professional experience he has worked across different projects and domains in the Compliance & Regulatory framework.

CAMS, CGSS, COMPLIANCE OFFICER MLRO TRANSFERGO

Egle is AML / Compliance enthusiast, speaker & lead in financial services industry with a strong research, automation, API & data empowering focus. Her focus areas are AML & compliance in regulated financial institutions, risk assessments mathematical modelling, fintech, ML/TF new typologies, innovative and tech focused financial services and products.

PARTNER AT WILLKIE FARR & GALLAGHER LLP

Dr. Richard W. Roeder is a partner in Willkie’s German practice. He is a member of Willkie’s Investigations & Enforcement, Global Trade & Investment, White-Collar Defense and Environmental, Social & Governance practice groups. He advises clients from various industries in the areas of ESG (in particular regarding Supply Chain-related laws and regulations), Anti-Bribery and Corruption, Anti-Money Laundering / Countering Terrorist Financing, Cybercrimes, Global Trade (in particular regarding compliance with Financial & Economic Sanctions as well as Export Controls).

LAWYER AT WILLKIE FARR & GALLAGHER LLP

Dr. Xianrui Wang is an associate in Willkie’s German practice. She is a member of the firm’s Corporate & Financial Services Department. She focuses on cross-border and national M&A and private equity transactions. Xianrui has been involved in transactions as an advisor to both buyers and sellers in the past. She also advises on general corporate law matters as well as participation and preparation of annual general meetings and shareholders’ meetings.

LAWYER/ASSOCIATE AT WILLKIE FARR & GALLAGHER LLP

Dr. Maximilian F. Schlutz is an associate in Willkie’s German practice. He is a member of Willkie’s Investigations & Enforcement, White-Collar Defense, Global Trade & Investment and Environmental, Social & Governance practice groups. He advises clients from various industries in the areas of Anti-Bribery and Corruption, Anti-Money Laundering / Countering Terrorist Financing, with a focus on Business-Partner Compliance / Third Party Management, and Compliance Management Systems.

CAMS-AUDIT, CAMS-FCI FINANCIAL CRIMES

Imad El Habre professional career spans over 16 years in the fields of Financial Crimes, AML, Compliance and Risk Management. He assumed senior and managerial roles in several local and international organizations related to banking and financial services where he was responsible for the implementation of major projects.

FOUNDER, FEATURESPACE

David Excell, founder of Featurespace, spearheads a revolutionary approach to combat financial crime and ensure regulatory compliance. His brainchild, the ARIC software platform, utilizes cutting-edge behavioral analytics to enable clients to make real-time decisions on customer management. Excell’s expertise bridges technology and business, as he collaborates closely with clients to translate their needs into actionable technical requirements.

SVP, DIRECTOR, FINANCIAL CRIMES RISK SURVEILLANCE, KEYBANK N.A.

Priyank P. serves as the Senior Vice President and Director of Financial Crimes Risk Surveillance at KeyBank. With a wealth of experience and expertise in financial crimes risk management, Priyank plays a crucial role in safeguarding KeyBank’s operations against illicit activities. His leadership in implementing effective surveillance measures ensures compliance with regulatory requirements and mitigates risks to the bank and its clients.

CHIEF EXECUTIVE OWL, OWL CONSULTANCY GROUP

Alexandra Solórzano is a seasoned professional renowned for her multifaceted expertise in investigations, illicit activity detection, and combating modern-day slavery. With a distinguished background as Chief Executive Owl and Founder, her prowess extends across various domains including uncovering dirty money trails, probing into bribery and corruption, and navigating complexities in international trade. Her acumen in risk mitigation, bolstered by an acute awareness of geopolitical dynamics, enables her to tackle challenges posed by organized crime and sanctions effectively.

CYBERSECURITY & PRIVACY PROFESSIONAL

Ionatan Waisgluss is a seasoned professional in Cybersecurity, Privacy, and OSINT, with extensive expertise and certifications including CIPP/C, PI, and CCI. Renowned for a relentless pursuit of knowledge in the ever-evolving tech landscape, Ionatan is deeply committed to safeguarding cybersecurity and privacy realms. With a robust skill set encompassing OSINT analysis, IMINT, Geolocation, and advanced search methodologies honed over years of dedicated work and research across business, security, and privacy domains, Ionatan stands out as a trusted authority in the field.

DIRECTOR OF KYC AND FINANCIAL CRIME, MOODY’S ANALYTICS

Richard Graham is a dedicated professional with a passion for combating financial crime through the intersection of technology, data analysis, and years of hands-on experience. As a seasoned fincrime/regtech executive and strategist specializing in the North American financial services sector, Richard possesses profound insights into AML and fraud-related technology and operations. Beyond his corporate endeavors, Richard serves as an elected Constable for the Town of Needham, Massachusetts, embodying his belief in the vital role of citizen engagement in democracy.

FINANCIAL CRIMES DUE DILIGENCE PRACTICE AT MOODY’S ANALYTICS

Jill DeWitt is a distinguished professional in the realm of financial crime compliance, currently serving as the Financial Crimes Due Diligence Practice Lead at Moody’s Analytics. With a dynamic career trajectory that saw her transition from high school teaching to the forefront of financial crime fighting, Jill brings a unique blend of expertise and dedication to her role. Previously, she spent over a decade at JPMorgan Chase, where she held various positions spanning branch banking, alternative investments, and KYC/AML operations.

HEAD OF LEGAL AND GOVERNMENT AFFAIRS, TRM LABS

Ari Redbord serves as the Global Head of Policy and Government Affairs at TRM Labs, a leading blockchain intelligence company. Renowned for his expertise in cryptocurrency policy and regulation, Ari also holds the position of Vice-Chair of the CFTC Technology Advisory Committee (TAC) and contributes to Forbes Crypto. His extensive experience positions him as a leading voice in shaping anti-money laundering strategies and regulatory frameworks.

CYBERCRIMES INVESTIGATOR ON THE CRYPTO INCIDENT RESPONSE (CIR) TEAM AT CHAINALYSIS

Mika Dahiya is a seasoned cybercrimes investigator, currently serving on the Crypto Incident Response (CIR) team at Chainalysis. With a wealth of experience in the field, Mika brings a sharp investigative mindset to tackle complex cybercrime cases involving cryptocurrencies. As a key member of the CIR team, Mika plays a crucial role in identifying and responding to illicit activities across blockchain networks.

DIRECTOR OF FINANCIAL CRIME, LEXIS NEXIS RISK SOLUTIONS

Tracy Manning is a seasoned Sr. Strategic Account Executive specializing in Digital Identity at LexisNexis Risk Solutions. With over two decades of experience in solution and strategy development, Tracy is dedicated to helping organizations across various industries transform their fraud prevention, identity proofing, and digital customer experiences using LNRS Digital Identity products and solutions.

GLOBAL HEAD OF SMES, FEATURESPACE

Roger Lester is the Global Head of SMEs at Featurespace, a leading provider of Adaptive Behavioural Analytics technology for fraud and risk management. With a background spanning from Lloyds to First Data, Roger brings extensive knowledge and expertise in cutting-edge Fraud Prevention Strategies and Systems. In his role at Featurespace, Roger focuses on supporting future development and maintaining relationships with existing and prospective clients to maximize the benefits of Featurespace’s innovative solutions.

FRAUD SUBJECT MATTER EXPERT, FEATURESPACE

Steve Goddard is a Fraud Subject Matter Expert at Featurespace, where he plays a pivotal role in bridging the gap between external clients and internal teams to drive product strategy and propose platform developments. With a keen understanding of the fraud industry, Steve leverages his expertise to solve problem statements related to financial fraud, ensuring Featurespace remains at the forefront of innovation. He represents Featurespace globally, contributing to the company’s reputation as a leader in fraud prevention solutions.

DIRECTOR OF GLOBAL POLICY AND REGULATION AT ELLIPTIC

Liat Shetret, CAMS, is a seasoned professional in policy and regulation, specializing in financial inclusion, AML/CFT, and cryptocurrency. With extensive experience in development, security, and financial integrity across Africa, the Middle East, and the U.S., Liat is recognized for her global strategic research and program development skills. As an instructor and thought leader, she excels in regulatory compliance, cross-border program management, and complex risk analysis.

CHIEF COMPLIANCE OFFICER AT NEST FINANCIAL GROUP

Marie-Noel Nsana, CAMS, CBP, CBE, is the Chief Compliance Officer at Nest Financial Group, bringing a wealth of expertise in financial crimes compliance, data protection, and the cryptocurrency industry. With over 15 years of experience, Marie-Noel is recognized for her proficiency in developing and maintaining compliance programs that align with corporate, legal, and regulatory requirements. Her leadership, relationship management skills, and commitment to compliance make her a valuable asset in the fintech industry.

PRESIDENT AT OXONIA

Joseph Bognanno, CAMS, CSS, is a seasoned professional with over 25 years of experience in the Financial Services industry. As the President of Oxonia and the COO & Co-Founder of Chrysalis DAE, Joseph specializes in applying technology solutions for risk management, financial crimes, and regulatory compliance. With a strong focus on Anti Money Laundering (AML) and fraud solutions, he has collaborated with leading technology providers and served in various roles, including consultant, US Regulator, and FS Executive.

SPECIAL COUNSEL WITH ARKTOUROS PLLC

Eric S. Medoff is a dedicated attorney known for his expertise in licensing policy and his exceptional patience in explaining complex legal matters. With a background in policy development at the state level and implementation at the Treasury, Eric possesses a unique ability to navigate regulatory dilemmas effectively, identifying solutions and achieving results efficiently.

CO-FOUNDER – CHIEF COMPLIANCE OFFICER, CHRYSALIS DAE

Douglas McCalmont is renowned as an anti-financial crime expert and financial compliance innovator, known for his adeptness in bridging the gap between blockchain and traditional economies. With a wealth of experience, Douglas has played a pivotal role in establishing blockchain platforms that bring value to areas traditionally overlooked by digital asset marketplaces.

GENERAL COUNSEL WITH CELO FOUNDATION

Jane Khodarkovsky is a multifaceted professional with a strong background in emergent technologies, AML/sanctions, DeFi, and litigation. As a former federal prosecutor, Jane brings invaluable insights and expertise to her roles as a founder, board member, and advisor. With a keen understanding of the intersection between law and technology, Jane is dedicated to driving innovation while ensuring compliance and legal integrity.

IRS-CI DEPUTY DIRECTOR OF CYBER AND FORENSIC SERVICES

Sherri serves as the Deputy Director at IRS Criminal Investigation, where she brings her extensive expertise to the forefront of combating financial crimes. With a commitment to upholding justice and integrity, Sherri plays a pivotal role in overseeing investigations and enforcing tax laws. Her leadership and dedication contribute to the agency’s mission of ensuring compliance and safeguarding the integrity of the tax system.

FORMERLY, HMRC DIRECTOR OF FRAUD INVESTIGATION SERVICE

Simon York is a highly regarded strategic advisor in financial crime and tax compliance, renowned for his distinguished tenure as the former Director of Fraud Investigation Service at HM Revenue and Customs (HMRC). With a wealth of experience, Simon led a team of 5000 professionals, including criminal investigators, tax experts, asset recovery specialists, and cybercrime professionals, with the mission of combatting serious fraud and protecting the UK's tax system.

CHIEF BUSINESS OFFICER, IVIX

Don Fort, currently serving as the Chief Business Officer at IVIX and Director of Investigations at Kostelanetz LLP, is a distinguished figure in the realm of financial crimes enforcement. With a notable tenure as the former Chief of the IRS Criminal Investigation Division, Don brings nearly 30 years of law enforcement experience to the table. His expertise spans financial crimes, data analytics, and cryptocurrencies, cultivated through overseeing investigations into various high-profile cases including tax evasion, money laundering, cybercrimes, and terrorist financing.

INDEPENDENT / FREELANCE C-SUITE FINANCIAL CRIME AND COMPLIANCE ADVISOR

Yannick Cherel is an esteemed Independent / Freelance C-Suite Financial Crime and Compliance Advisor, offering senior-level expertise across Transaction Banking, Securities Services, and Cryptoassets Industries. With a wealth of achievements under his belt, Yannick has led robust compliance and financial crime teams across diverse financial sectors, empowering them to excel and significantly contribute to business success.

Learn In-Demand Skills with On-Demand Courses

Gain the relevant skills and knowledge to ensure that you are supporting your firm and progressing your career.

Earn a certificate of completion for each online training that you successfully go through.

Our online courses empower anti-financial crime professionals develop relevant knowledge and best practice for operating within the fields of governance, risk and compliance, financial crime prevention, and anti-money laundering (AML).