Which documentation requirements should be kept? Keep all documents with evidence of the background, the purpose of the transactions, the trigger, the investigation carried out, and all findings and conclusions.

Record keeping applies for the cases where you filed a SAR and for any case opened, closed, and not reported. The documentation should be self-explanatory.

SARs Documentation Requirements

This means that a colleague should be able to review and understand the case in a short period if law enforcement comes back with questions. Ensure that a qualified third party like auditors or regulators can follow the rationale and background. The information should be easily available for Investigators or Financial Crime Officers on a need-to-know basis to assist law enforcement if they have follow-up questions.

Suppose you decide that an action or transaction that seemed unusual has a reasonable explanation. In that case, it is right not to file a SAR. But there are also wrong reasons not to file a SAR, which you need to avoid. Willful blindness is a legal principle used in money laundering and other cases in some jurisdictions. Willful blindness is the “deliberate avoidance of the knowledge of facts” or “purposeful indifference.”

Another reason are backlogs which prevent institutions from filing SARs promptly. Having a backlog or staffing issues is never an acceptable reason not to file a SAR promptly.

Sometimes you will feel pressure from your institution’s business side not to lose an important client. This is a short-sighted approach with serious consequences. Your MLRO should be independent of the business.

SARs Supporting Documentation

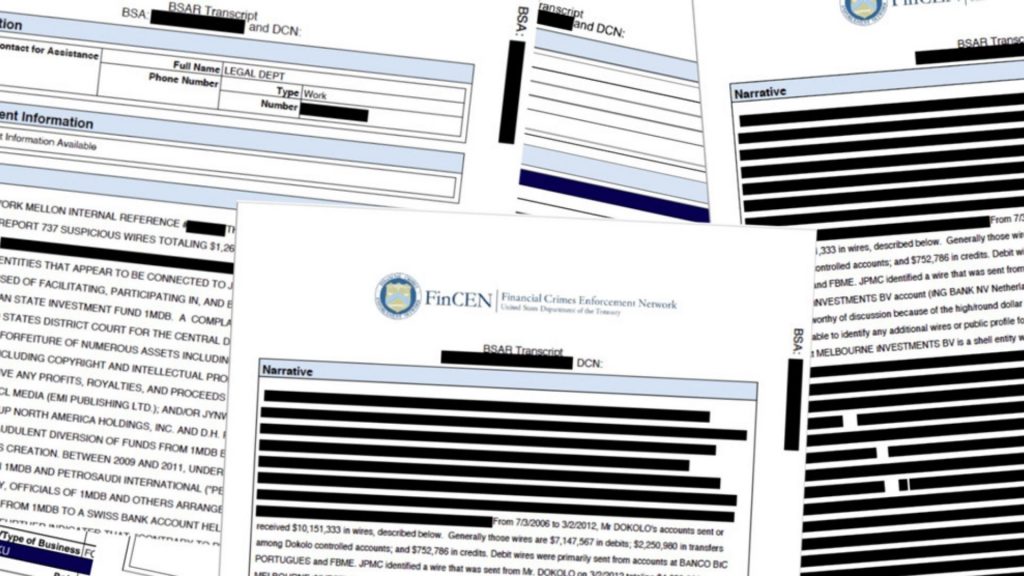

This guidance is being issued by the Financial Crimes Enforcement Network (FinCEN)1 to clarify:

- The Bank Secrecy Act (BSA) requirement that financial institutions provide supporting documentation for Suspicious Activity Reports (SAR) in response to requests from FinCEN and appropriate law enforcement or supervisory agencies;

- What is meant by “supporting documentation” in SAR regulations; and

- When the disclosure of supporting documentation necessitates the use of legal process.

Disclosure of Supporting Documentation to FinCEN and Appropriate Law Enforcement or Supervisory Agencies

When a financial institution files a SAR, it must keep a copy of the SAR as well as the original or business record equivalent of any documentation requirements for five years from the date of filing. Upon request from FinCEN or an appropriate law enforcement5 or supervisory agency, financial institutions must provide all documentation supporting the filing of a SAR.

When asked to provide supporting documentation, financial institutions should take extra precautions to ensure that the requestor is, in fact, a representative of FinCEN or another appropriate law enforcement or supervisory agency. A financial institution‘s BSA compliance or anti-money laundering program should include procedures for such verification. These procedures may include independent employment verification with the requestor’s field office or a face-to-face review of the requestor’s credentials, for example.

The safe harbor provisions, which apply to both voluntary and mandatory suspicious activity reporting by financial institutions, protect the disclosure of SARs to appropriate law enforcement and supervisory agencies.

What Constitutes Supporting Documentation

The term “supporting documentation” refers to all documents or records that assisted a financial institution in determining that a particular activity required a SAR filing. When filing a SAR, a financial institution must identify supporting documentation, and this documentation must be kept on file by the institution.

The manner in which a financial institution keeps supporting documentation may differ from one institution to the next, but each institution should specify its own method in its anti-money laundering program written procedures. For example, a financial institution’s procedures may require that all supporting documentation for a specific SAR be kept in a single file folder or scanned and saved in a data file.

What constitutes supporting documentation is determined by the facts and circumstances of each filing. Financial institutions should identify the supporting documentation in the SAR narrative, as indicated in each of the SAR forms, which may include, for example, transaction records, new account information, tape recordings, e-mail messages, and correspondence. While items identified in the SAR’s narrative are generally considered supporting documentation, a document or record may qualify as supporting documentation even if it is not identified in the narrative.

No Legal Process is Required for Disclosure of Supporting Documentation

In general, the Right to Financial Privacy Act (RFPA) prohibits financial institutions from disclosing a customer’s financial records to a government agency without service of legal process, notice to the customer, and an opportunity to challenge the disclosure.

When a financial institution provides financial records or information to FinCEN or a supervisory agency in the course of performing its “supervisory, regulatory, or monetary functions,” however, no such requirement applies. Furthermore, when FinCEN or an appropriate law enforcement or supervisory agency requests a copy of a SAR or supporting documentation underlying the SAR, no such requirement applies.

In terms of supporting documentation and documentation requirements, BSA rules state expressly that financial institutions must keep copies of supporting documentation, that supporting documentation is “deemed to have been filed with” the SAR, and that financial institutions must provide supporting documentation upon request. FinCEN has interpreted these BSA regulations as requiring a financial institution to provide supporting documentation even if no legal process is in place.

FinCEN believes that this is consistent with the RFPA, which states that nothing in the act “authorizes the withholding of financial records or information required to be reported in accordance with any Federal statute or rule promulgated thereunder.”

Final Thoughts

It is the responsibility of financial institutions to report suspicious transactions and the documentation requirements to authorities when they become aware of them. This is done to prevent potential criminal behavior, such as money laundering or terrorism financing. In most countries, suspicious activity is reported by submitting a suspicious activity report (SAR), a document sent by a financial institution to the appropriate authority in accordance with compliance regulations.

Financial institutions should understand when and how to report suspicious activity to the appropriate authorities, and they should ensure that their AML program is set up to make the process as easy as possible