Reinventing compliance management through integrated programs offers an advanced, coordinated approach to risk assessment and mitigation, positioning organizations effectively to counteract financial crime risks at every level of operation.

The benefits of taking an integrated compliance program approach to compliance management are vast. Depending on where your program stands today, it can enhance your functionality or completely transform the risk assessment and mitigation approach. When considering entity-wide integrating compliance programs, there is a need to identify the key interlinked program components.

The compliance and fraud risk management teams should focus on developing an extensive integrated program, for the prevention and management of financial crime risks.

Reinventing Compliance Management: Building an Integrated Program

Components of Integrated Program

The program integration requires the development of the following interlinked components:

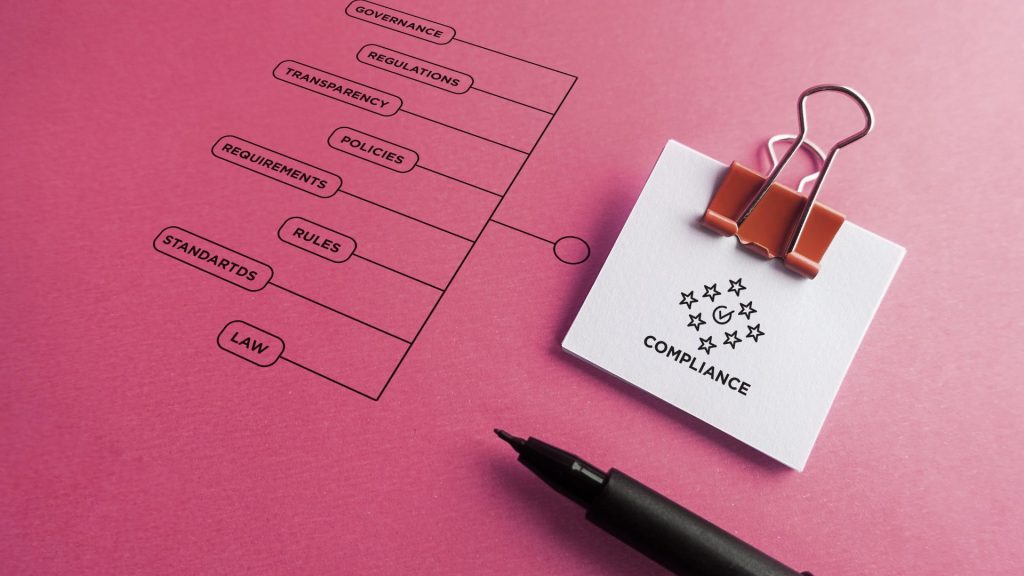

- Risk-based compliance program, including the laws, regulations, standards, and requirements of financial crimes, including money laundering, terrorist financing, bribery, corruption, insider trading, data protection, human trafficking, cybercrimes, frauds, etc.

- Performance of risk-based integrated assessments, for all products, services, channels, and jurisdictions, and consider all financial crime risks, to identify and analyze significant financial crime risks, including money laundering, terrorist financing, bribery, corruption, insider trading, data protection, human trafficking, cybercrimes, frauds, etc.

- Risk-based integrated compliance policies and procedures, including the laws, regulations, standards, and requirements of financial crimes.

- Integrated compliance monitoring, and

- Effective compliance training.

The application of an integrated program enables, the implementation of a 360-monitoring approach to identify and prevent financial crimes. It requires all the key stakeholders working in the organization, to collaborate and share relevant information to develop a comprehensive and risk-aligned integrated compliance program and policies.

Stakeholders Required to Collaborate and Coordinate

The stakeholders who should collaborate and coordinate for the development of an integrated compliance program, include all the key positions and personnel working in the organization. They may include:

- Business and sales team, including the heads and unit heads,

- Product development personnel, including the heads and unit heads,

- Operations team,

- Transactions investigation and reporting team,

- Money laundering reporting officer (MLRO), and the key officials of the anti-money laundering team,

- Financial crime reporting officer (FCRO), and the key officials of the anti-financial crime team,

- Information security and cybersecurity team,

- Chief Risk Officer (CRO),

- Fraud risk management team,

- Compliance risk management team,

- Operational risk management team,

- Internal controls team,

- Chief Technology Officer, and Information technology or technology deployment team,

- Data and data sources management team,

- Customer complaint handling team, etc.

Application of Program

Once, the risk-aligned program and policies are developed, then all must assume responsibility to comply with them, for all key processes, such as:

- Setting risk-based customer transactions scenarios,

- Setting transaction thresholds for monitoring purposes,

- Identification and classification of high-risk category customers,

- Identification of high-risk jurisdictions,

- The setting of the right customers’ risk profiles,

- Real-time update of customer profiles,

- A risk-based red alert mechanism,

- Setting cross-border transactions analysis and review parameters,

- Setting criteria to accept or reject transactions,

- Performing effective risk-based risk assessments, including fraud risk assessments, money laundering and terrorist financing risk assessments, technology risk assessments, product delivery, channel risk assessments, etc.

- Identifying unauthorized access,

- Performing digital customer onboarding,

- Setting real-time technology-based payment reviews and settlements authorization,

- Identification and assessment of suspicious transactions or activities,

- Transactions investigations,

- Timely and correct regulatory reporting,

- prevention of interlinked financial crimes,

- Prevention of financial crimes,

- Identification of countries subject to sanctions, embargoes, or similar measures issued by, for example, the Union or the United Nations,

- Identification of countries providing funding or support for terrorist activities, or that have designated terrorist organizations operating within their country, etc.

For example, when an organization takes a 30-degree approach to managing financial crime risks, then the process is implemented right at the start of customer onboarding till the time the relationship is terminated or ended. During the relationship, all customer-related data, such as customer profiles, customer identity data, sources of income, transactions, and activities are updated and used for risk assessment purposes.

The integrated approach makes the overall risk assessment process more robust and comprehensive, by including:

- More relevant data points, and information,

- More enhanced risk sources,

- Current and updated information of customers,

- Predictive or emerging financial crime risks,

- Product, service, customer, and institution-level regulatory requirements, etc.

Similarly, the product and channel risk assessments are performed considering all product and channel-related risk factors, such as compliance risks, fraud risks, product misuse risks, product compliance risks, bribery risks, trade-based money laundering risks, etc.

Final Thoughts

The Power of Integrated Programs in Mitigating Financial Crime Risks”, we delve into the significant benefits of adopting an integrated compliance program approach to risk management. This comprehensive approach provides an enhanced functionality or complete transformation of risk assessment and mitigation processes.

By effectively interlinking key components such as risk-based compliance, integrated compliance policies and procedures, compliance monitoring, and robust training, an integrated program fosters a collaborative environment that harnesses collective intelligence and creates a 360-monitoring approach to combat financial crimes. This post highlights the essential roles of key stakeholders, practical application of the program, and the expansive reach of integrated programs in providing more robust risk assessments.