Today, the struggle against financial crimes is more important than ever, given our interconnected financial landscape. The Bank Secrecy Act (BSA) is a pivotal player in this fight, shaping the operations of financial institutions and aiding the global effort to combat money laundering, terrorist financing, and other illicit financial activities. But what is the BSA, and what impact does it have on financial institutions and the broader financial system? Let’s delve into the crucial facets of the BSA, its advantages, challenges, and the best practices for compliance.

Key Takeaways

The Bank Secrecy Act (BSA) is a piece of U.S. legislation that mandates financial institutions to establish customer identification programs, monitor and report suspicious activities, and adhere to other regulatory requirements.

The BSA’s primary objective is to identify and prevent financial crimes by obligating financial institutions to report any suspicious activities.

To safeguard against money laundering and other illegal activities while providing law enforcement with necessary information, financial institutions must comply with the BSA.

The Bank Secrecy Act (BSA) Explained

The Bank Secrecy Act (BSA), also known as the Currency and Foreign Transactions Reporting Act of 1970, is a U.S. law that empowers the Department of the Treasury to mandate specific requirements on financial institutions. This is done to enhance the detection and prevention of money laundering. Key features of the BSA include customer identification programs (CIP), surveillance and reporting of suspicious activities, and the implementation of internal guidelines and procedures. These measures aid in tracing cash transactions and obstructing financial crimes.

The BSA is a crucial line of defense against threats such as cybercrime, fraud, and other illicit financial activities that the United States faces. It works in tandem with other regulations like the Federal Deposit Insurance Act to maintain the stability and security of the financial system. The most effective ways to ensure compliance with BSA include:

Keeping meticulous records of all transactions

Submitting reports concerning currency exchanges and transportation of certain monetary instruments surpassing $10,000

Recognizing and observing potential money laundering activities

Submitting Form 8300

BSA compliance necessitates the implementation of anti money laundering programs.

Purpose of the BSA

The Bank Secrecy Act (BSA) is a regulatory measure aimed at detecting and halting financial crimes such as money laundering, funding of terrorism, and tax evasion. The BSA imposes specific responsibilities on financial institutions to assist the government in identifying and thwarting these crimes. These responsibilities include maintaining records and reporting certain transactions. For example, financial institutions offering services to Marijuana Related Businesses (MRBs) are required to file Suspicious Activity Reports (SARs) and Currency Transaction Reports (CTRs) for certain transactions. As per section 6216(a)(1)(A) of the Anti-Money Laundering (AML) Act, the Treasury is required to implement suitable and essential safeguards. The goal is to protect our financial system from national security threats that can emerge from various forms of financial crime.

Fundamentally, the BSA seeks to:

Foster a transparent financial environment that facilitates the detection and prevention of illicit activities

Require financial institutions to maintain detailed records and report specific transactions

Supply crucial information to law enforcement agencies to combat financial crimes and protect the financial system’s integrity.

Key Components of the BSA

As we’ve previously explored, the BSA places emphasis on three main components: customer identification, tracking and reporting of suspicious activities, and the creation of internal policies and procedures. Financial institutions are obligated to document any cash transactions that exceed $10,000 within a single day. In addition, financial institutions are obligated to report any transactions that they suspect could be related to tax evasion, money laundering, or other illicit financial activities.

Some examples of reports mandated by the BSA include:

Suspicious Activity Reports (SARs)

Currency Transaction Reports (CTRs), also known as currency transaction report

Reports of Currency or Monetary Instruments (CMIRs)

Reports of Foreign Bank and Financial Accounts (FBARs)

By setting up these stringent reporting and recordkeeping requirements, the BSA lays out an extensive blueprint for financial institutions to detect, supervise, and report potential financial crimes, thereby fostering a more transparent and secure financial landscape.

Exploring the Connection Between the Bank Secrecy Act and Anti-Money Laundering

The BSA, by requiring financial institutions to identify and report activities that could signal money laundering or other financial crimes, is a cornerstone of AML initiatives. By keeping thorough records of transactions and reporting certain transactions to the relevant authorities, financial institutions help foster a transparent financial environment where illicit activities are more readily identified and prevented.

Fundamentally, the BSA acts as the bedrock for AML efforts in the United States, providing a solid framework for identifying, preventing, and reporting financial crimes. Adherence to the BSA not only assists financial institutions in meeting their legal responsibilities but also plays a crucial role in the wider fight against money laundering, terrorist financing, and other unlawful financial activities.

Compliance with the Bank Secrecy Act

Compliance with the Bank Secrecy Act (BSA) involves the implementation of a Customer Identification Program (CIP), monitoring and reporting of suspicious activities, and the development of internal policies and procedures. These steps are crucial for financial institutions in order to successfully implement an Anti-Money Laundering (AML) compliance program and to aid the government in identifying and preventing money laundering and other financial crimes. Moreover, it is essential for financial institutions to adhere to the BSA to prevent money laundering and other financial wrongdoings.

Regulatory bodies, such as the Financial Crimes Enforcement Network (FinCEN) and the Office of the Comptroller of the Currency (OCC), are tasked with enforcing the BSA and ensuring that financial institutions comply with the relevant laws and regulations. They scrutinize the institution’s policies and procedures to confirm their compliance. By complying with the BSA, financial institutions not only fulfill their legal duties but also contribute significantly towards a more transparent and secure financial infrastructure.

Customer Identification Program (CIP)

The Customer Identification Program (CIP), an essential part of BSA compliance, requires financial institutions to validate the identities of their customers. This process is crucial in preventing fraudulent activities and money laundering. The CIP contributes to a transparent financial environment and helps in the larger battle against financial crimes.

To meet CIP requirements, financial institutions must have procedures in place for identifying customers. This includes gathering basic identification information and confirming the customer’s identity through documents or non-documentary methods. By having a strong CIP in place, financial institutions can reduce the risk of being a conduit for money laundering or other financial crimes, safeguard their reputation, and uphold the integrity of the financial system.

Monitoring and Reporting Suspicious Activity

Keeping an eye on customer transactions and promptly reporting any suspicious activities to the appropriate authorities is a requirement for financial institutions. Suspicious Activity Reports (SARs) are a critical instrument for financial institutions to notify U.S. authorities about transactions that may be suspicious. By maintaining thorough records of transactions and reporting specific ones, financial institutions help foster an environment of financial transparency where illicit activities can be more easily detected and prevented.

The monitoring and reporting of suspicious activities is a vital part of BSA compliance because it aids financial institutions in identifying and reporting potential financial crimes. By closely monitoring customer transactions and promptly reporting any suspicious activities, financial institutions can contribute significantly to the global effort to combat money laundering, terrorist financing, and other illicit financial activities.

Internal Policies and Procedures

Having internal policies and procedures in place is vital for financial institutions to establish a strong AML compliance program.These policies and procedures provide guidance on how employees should behave in the workplace and detail the organization’s expectations and practices. Some examples of internal policies and procedures include:

Employee training

Customer identification

Monitoring and reporting suspicious activity

By formulating and upholding strong internal policies and procedures, financial institutions can guarantee that their staff are well-versed and informed about the requirements of BSA compliance. This, in turn, serves to:

Mitigate the risk of facilitating money laundering or other financial crimes

Protect the institution’s reputation

Maintain the integrity of the financial system.

The Role of Regulatory Agencies in BSA Enforcement

Regulatory bodies like the Financial Crimes Enforcement Network (FinCEN) and the Office of the Comptroller of the Currency (OCC) are critical in ensuring that financial institutions adhere to BSA regulations. FinCEN is in charge of overseeing BSA-related reporting requirements for national banks and savings associations, mandating that financial institutions file reports electronically through the BSA E-Filing System.

On the other hand, the OCC is responsible for issuing regulations, conducting supervisory activities, and taking enforcement actions to make sure that national banks have the necessary controls in place and provide the required notifications to law enforcement to prevent and detect money laundering, terrorist financing, and other criminal activities. These regulatory agencies, by enforcing BSA compliance and providing guidance to financial institutions, contribute to a more transparent and secure financial system.

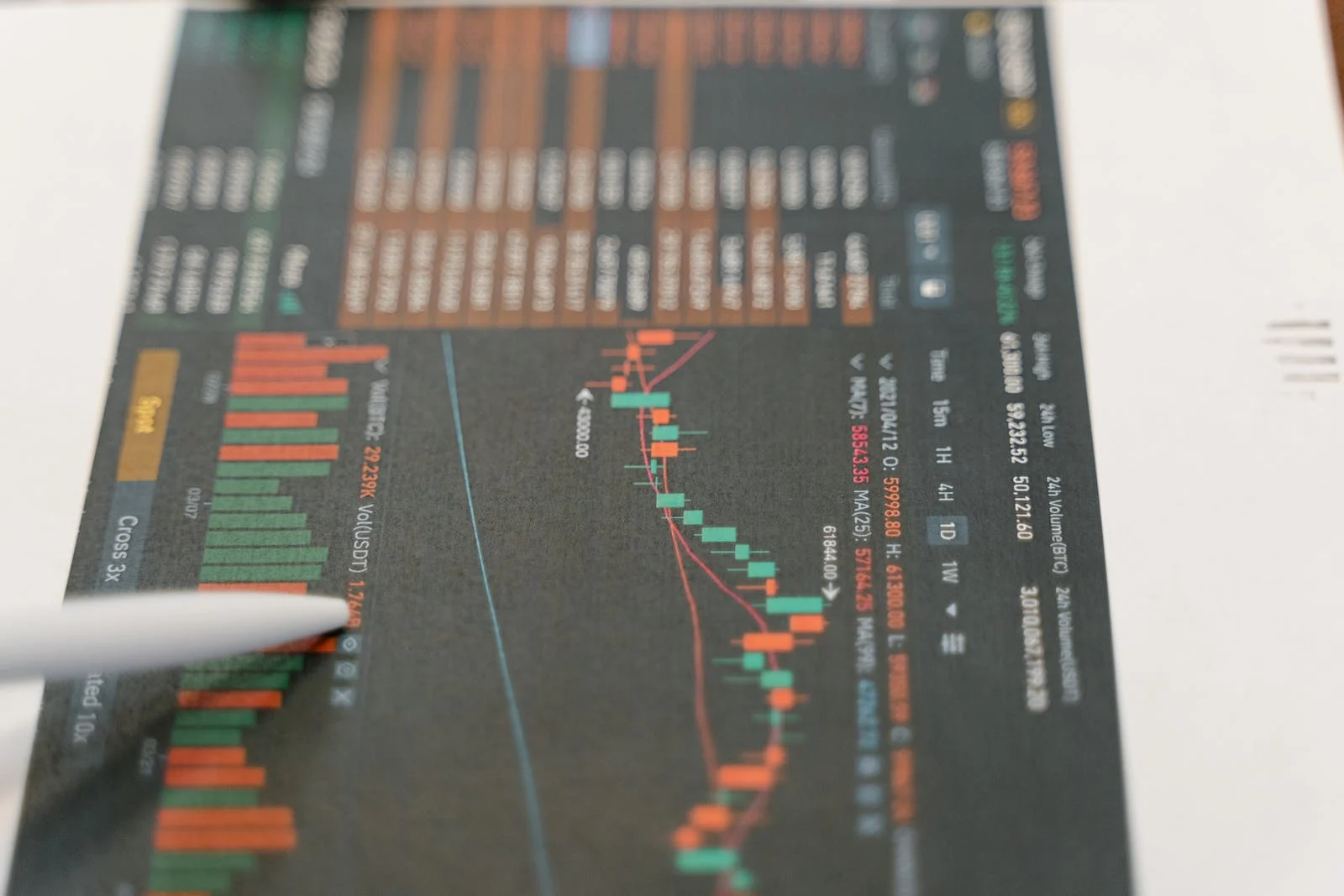

The Influence of Technology on BSA Compliance

Technology plays a pivotal role in enhancing BSA compliance, as it simplifies procedures, boosts monitoring capabilities, and augments data analysis. For instance, automated transaction monitoring systems can identify abnormal activity patterns that might suggest money laundering or other financial crimes. Similarly, customer due diligence systems assist financial institutions in confirming customer identities and evaluating the risk of potential criminal activity.

As technology advances, it creates more opportunities to bolster BSA compliance efforts. Financial institutions that invest in state-of-the-art technology are positioned to:

Improve their ability to detect and report suspicious activities

Stay ahead of emerging financial crime trends

Maintain the integrity of the financial system.

Challenges and Criticisms of the Bank Secrecy Act

While the BSA plays a vital role in thwarting financial crimes, it has not been without its share of criticisms and obstacles. One of the primary concerns is the heavy data collection responsibility imposed on financial institutions. They are required to maintain detailed records and report specific transactions to the appropriate authorities. This can pose a significant hurdle, particularly for smaller financial institutions that might not possess the requisite resources to effectively handle such comprehensive data collection and reporting obligations.

In addition to this, the sheer volume of data that needs to be processed and analyzed can be overwhelming. Financial institutions are expected to sift through countless transactions, identifying any that could potentially be linked to illicit activities. This requires sophisticated data analysis tools and skilled personnel who can interpret the data correctly.

Furthermore, the penalties for non-compliance can be severe, putting additional pressure on financial institutions to ensure they are fully compliant with BSA regulations. This can lead to a risk-averse culture, with institutions potentially over-reporting in an attempt to avoid penalties, resulting in a flood of reports that can make it harder for authorities to identify genuine cases of illicit activity.

Moreover, the BSA has been criticized for its lack of clarity in certain areas, which can make it difficult for financial institutions to know exactly what is expected of them. This has led to calls for clearer guidance and more detailed regulations to help institutions comply with the BSA’s requirements.

One of the challenges is the urgent need for the BSA to evolve in line with the rapid technological advancements and new trends in financial crime. As technology continues to progress, both financial institutions and regulators must work together to update and adapt BSA regulations. This is vital to effectively tackle the evolving nature of financial crime and ensure the continued efficacy of the legislation in the fight against money laundering, terrorist financing, and other illegal financial activities.

Benefits of BSA Compliance for Financial Institutions

Compliance with BSA regulations offers several significant advantages for financial institutions. One of the primary benefits is the reduction in the risk of financial crimes. By following the BSA’s reporting and recordkeeping requirements, financial institutions create a challenging environment for criminals to exploit for money laundering and other illicit activities. This not only helps to uphold the integrity of the financial system but also protects both the institution and its customers.

Moreover, compliance with BSA regulations fosters an environment of transparency and accountability within financial institutions. This culture encourages trust among customers and stakeholders, thereby enhancing the institution’s reputation in the financial industry. It also signals the institution’s dedication to ethical business practices and a firm stance against financial crimes.

BSA compliance also provides a structured framework for financial institutions. This framework includes guidelines for customer identification, transaction monitoring, and reporting of suspicious activities. Adherence to the guidelines of the Bank Secrecy Act allows financial institutions to play a crucial role in preserving the integrity of the global financial system.

Furthermore, BSA compliance can also lead to operational improvements. The systems and processes required for BSA compliance often result in more streamlined operations, leading to increased efficiency and effectiveness in daily tasks. This operational efficiency can result in cost savings, making adherence to BSA not just a legal and ethical requirement but also a financially sound business decision.

Moreover, compliance with BSA regulations helps to safeguard the reputation of financial institutions by demonstrating their commitment to preventing financial crimes and adhering to industry best practices. Institutions that fail to comply with BSA regulations may face penalties, fines, and reputational damage. Therefore, compliance is not only a legal obligation but also a strategic business decision.

BSA Compliance Best Practices

Embracing a risk-based strategy, leveraging technology, and offering continual training to employees are vital components for ensuring solid BSA compliance within financial institutions. A risk-based strategy entails systematically identifying, evaluating, and managing the risks associated with certain activities or processes. By concentrating on the highest risk areas, financial institutions can more effectively distribute resources and lessen the potential fallout from financial crimes.

Moreover, a risk-based approach allows financial institutions to tailor their compliance programs to their specific needs and risk profiles. This could involve carrying out regular risk assessments, implementing enhanced due diligence measures for high-risk clients, and consistently revising and updating risk management policies and procedures to ensure they remain up-to-date and effective.

Investing in technology is another crucial element for achieving successful BSA compliance. Technological solutions can dramatically enhance the efficiency and accuracy of compliance processes, ranging from automating transaction monitoring to streamlining customer due diligence procedures. Advanced technologies such as artificial intelligence and machine learning can even assist in identifying complex patterns of suspicious activity that might otherwise go unnoticed.

Lastly, continual employee training is an essential part of any successful BSA compliance program. By providing regular training on BSA regulations, financial institutions can ensure their staff are well-equipped to identify and report suspicious activities. Training programs should be regularly updated to reflect changes in regulations, emerging trends in financial crime, and lessons learned from past compliance issues.

Investment in technology can aid financial institutions in automating transaction monitoring, customer due diligence, and other compliance-related processes, resulting in more efficient and accurate detection and reporting of suspicious activities. Consistent employee training is also crucial to ensure that employees stay informed about the latest regulations and best practices and are equipped to identify and report potential financial crimes.

Summary and Conclusion

In conclusion, the Bank Secrecy Act is a critical tool in the fight against financial crimes and the preservation of the financial system’s integrity. Adhering to BSA regulations is a necessity for financial institutions to shield themselves, their customers, and the broader financial system from the risks associated with money laundering, terrorist financing, and other illegal financial activities.

By adopting best practices such as risk-based strategies, incorporating cutting-edge technology, and offering ongoing employee education, financial institutions can effectively combat financial crimes and contribute to a more secure and transparent global financial landscape.

Frequently Asked Questions

What are the Bank Secrecy Act and anti money laundering?

The Bank Secrecy Act is a piece of US legislation designed to impede money laundering and financial crimes. In contrast, anti-money laundering refers to the strategies and procedures implemented to combat these crimes. The Bank Secrecy Act mandates that financial institutions implement anti-money laundering (AML) programs. These programs are designed to detect and report any suspicious activities, thus creating a financial environment that is transparent and where illicit activities can be more easily spotted and halted.

What is the idea and objective of bank secrecy?

Bank secrecy involves maintaining the confidentiality of customer information by financial institutions. The purpose of bank secrecy, as regulated by laws including the Bank Secrecy Act, is to safeguard the privacy and confidentiality of personal financial transactions and accounts. This prevents financial institutions from being misused for activities such as money laundering and other financial crimes.

What do you understand by anti-money laundering guidelines?

Anti-money laundering guidelines consist of:

The creation and implementation of laws, regulations, and procedures aimed at detecting and thwarting the transformation of illicitly gained money into legitimate assets

Mandates such as the execution of customer due diligence

The surveillance of transactions

The reporting of potentially suspicious activities

The execution of regular risk evaluations.

Compliance with AML guidelines is crucial for maintaining the integrity of the financial system and protecting it from illegal activities.

What does banking secrecy signify?

Banking secrecy signifies the commitment of financial institutions to maintain the privacy of their clients’ information, not divulging it to third parties unless authorized by the client or mandated by law. It serves as a protective measure for individual financial transactions and accounts, thereby enhancing the security and transparency of the financial system.